As of January 1st 2021, the United Kingdom is no longer a member of the European Union. The UK has left the EU Customers Union and Single Market, and this impacts the movement of goods between the UK, the EU and third-party countries. At Pallet2Ship, we continue to work with our partners to safely ship your goods but we recognise the need for you to fully understand the changes, in terms of administration and also additional charges in some instances.

All companies which trade between the UK and EU or trade with the UK using EU Free Trade Agreements are affected by Brexit. The way you operate will be impacted and you need to make changes to ensure you’re keeping in line with the new legislation and are able to trade legally and ensure your goods reach their destination.

The Impact of Brexit on Import and Export Businesses

The UK leaving the EU will impact imports and exports, however you transport your goods to and from each country.

All UK registered vehicles must apply for an international driving permit. You need a European Conference of Ministers for Transport (ECMT) permit for laden and unladen journeys through both EU and EEA countries. UK haulage accounts for 8% of the total haulage activity in the EU so it is important to understand how to transport goods legally and within the new guidelines so business can continue as usual.

For air freight, cargo services between EU states and third countries are capped at 2018 flight frequency levels. Swapping to air freight is a popular choice to minimise delays and avoid the Channel Tunnel but it is important to assess the impact of Brexit on your freight routes before making a final decision.

Brexit will not impede the right of British shipping companies to carry goods to or from EU ports. There are no additional duties on general cargo between the EU and the UK but import and export declarations are now mandatory which does add an additional bureaucratic level to the shipping process. Shipping companies carrying passengers and trucks, from the UK to the EU will be required to submit further security information to the port before entering, so this is another time factor to consider in the shipping process.

Imports from the European Union to the United Kingdom

The EU / UK Trade & Cooperation Agreement (TCA) only allows for the duty-free movement of UK and EU originating goods. This means there may be additional costs for some shipments, which you need to understand before placing any orders or budgeting for your pallet and shipment deliveries.

In practical terms this means:

If you are shipping goods from China, you must pay duty on entry to the UK, even if duties were already paid in the EU.

However, if you are importing goods into France from the UK this will still be duty free, but only if you provide the correct statement of origin with the goods.

The statement of origin is one of the key administrative changes to keep in mind when importing and exporting. It must be included on invoices and any other commercial document. It must describe the originating product in enough detail to ensure it can be identified.

There are further administrative requirements to satisfy when importing from the EU to the UK as detailed below:

VAT Changes

Brexit impacted VAT in a number of different circumstances. The liability for VAT payments depends on the incoterms agreed upon and the payment terms of the shipment. Incoterms will be explored in more depth below and are an internationally recognised standard you may already be used to using if you ship to countries beyond the EU.

If you are exporting from the UK into the EU on your behalf (e.g., incoterm Delivered Duty Paid), your business is liable for both duty and import VAT and if you are delivering directly to your customers, you will also need an EU VAT registration.

Customs Clearance

All shipments require customs clearance. Previously, this wasn’t necessary with other EU member states, but the UK no longer has this status so full customs clearance must be provided. Businesses and individuals that haven’t shipped outside of the European Union will need to get accustomed to and gain an understanding of customs procedures and relevant documentation.

Customs clearance allows HM Customs and Excise to account for duties and charges, ensure correct documentation has been provided and check that all shipments conform with EU law. It also allows Customs to appropriately monitor goods coming in and out of the UK.

Additional Documentation

Whether shipping to or from the UK or the EU, there is additional documentation to carry this out legally. Shipping packages and pallets safely and compliantly is important to keep your business running smoothly and our expert teams are here to work with you to ensure compliance at every stage of the process.

Shipping Documentation and Legislative Requirements

Even if you’ve regularly shipped to European Union countries in the past, these changes are still applicable to you and you need to consider the following documentation requirements to ship your goods safely:

EORI

A key element you need to import and export between the UK and EU is an EORI number. EORI stands for Economic Operator Registration and Identification number and it is a legal requirement for all import and export companies.

To get an EORI number you can register via the Government website where you can also find additional information about the type of number you need to ship and receive goods legally. In the UK, for example, your EORI number must begin with GB. EORI numbers are a mandatory requirement for all shipping into the EU from the UK and vice versa.

Commercial Invoice

Commercial invoicing is not a new development for businesses which regularly ship outside of the European Union. However, if all your custom is within the EU, then understanding and providing commercial invoices is something you need to learn. They are an essential piece of documentation which must be included with every shipment to the EU, with no exceptions.

The commercial invoice lays out the goods and their value, ensuring Customs and Excise can calculate the customs duties owed. Pallet2Ship customers must use our website to generate their commercial invoices which helps expedite and streamline the process.

Incoterms

As already referenced, Incoterms rules are terms of trade for the sales of good worldwide. They have international recognition for ease of use and bring together 11 rules to define the responsibilities of buyers and sellers in every sale or purchase. Incoterms specify who is responsible for paying for and managing shipment, insurance, documentation, customs clearance, and other logistical activities. It is important to agree incoterms with your customer as they must be included on the Commercial Invoice. You can find out more about Incoterms in this guide.

Commodity Codes

Your national customs authority should be able to help you find the right codes for your shipments if you aren’t sure where to start. Commodity codes classify your goods so export declarations can be properly completed. Most customs authorities are extremely helpful and provide comprehensive guidance and support to help importers and exporters carry out their business with ease.

Tax Liabilities

Companies receiving goods from the European Union are legally obliged to pay Duty and Taxes (VAT) unless you have exceptions in place, such as the sender accepting the charges, in the contract of sale. The chosen Incoterm for the shipment should make all tax liabilities clear.

Working with a Customs Broker

You may opt to work with a customs broker who can handle the customs clearance requirements for your shipments. This may be particularly useful if you are new and inexperienced when it comes to this new level of administration and the paperwork that comes with it. Pallet2Ship acts as customs broker for many of our clients and can work with you to ensure shipments are processed as quickly and efficiently as possible.

Defer Duty Payments

You can apply for a duty deferment account to delay paying most customs charges, for example:

- Customs Duty

- Excise duty

- Import VAT

A duty deferment account lets you make monthly Direct Debit payments instead of paying for individual consignments. It can be an effective way of managing your capital and ensuring your shipments are not affected.

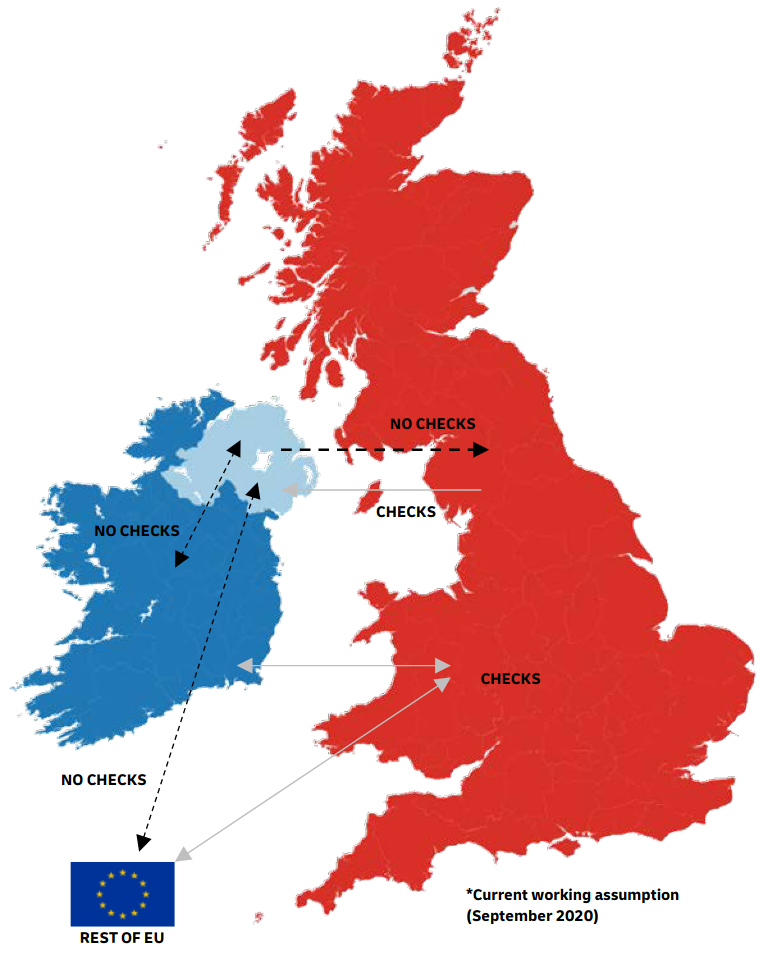

Brexit and Northern Ireland

The rules around Northern Ireland are slightly different to the rest of the United Kingdom due to the Irish sea border. Checks will not be in place between Northern Ireland and the Republic of Ireland, and Northern Ireland will also continue to follow some EU regulations, with HGVs able to drive across the border without inspections.

As Great Britain will not be following EU rules since leaving, there is now what is known as a regulatory border between Northern Ireland and the rest of the United Kingdom. The main points to remember are:

- Northern Ireland is still part of the UK’s custom territory and benefits from all trade agreements the UK signs with other nations.

- The EU Union Custom Code applies to trade between Northern Ireland and the Republic of Ireland. No tariffs or restrictions on trade will apply.

- Goods shipped from Great Britain to Northern Ireland are subject to customs declaration but are tariff free.

- Goods shipping to Northern Ireland from third countries outside of the EU will be subject to the UK Global Tariff. However, if goods are at risk of entering the EU market, EU tariffs will apply but the UK authorities must reimburse businesses if goods are proven to stay in Northern Ireland.

- Northern Ireland remains in the UK VAT area but will align with EU VAT rules. If the Republic of Ireland has lower VAT rates or exemptions, Northern Ireland will also benefit from this.

Support for Northern Irish businesses and those trading with Northern Ireland is available in a range of packages including the free-to-use Trader Support Service and a £155m fund committed to developing technologies to make new processes as streamlined as possible.

The team at Pallet2Ship are working to ensure our customers can continue their pallet deliveries to and from the EU without difficulty. We’ll handle as many concerns as we can for you but meeting the requirements above is important before you place an order.

Brexit at a glance

Here at Pallet2Ship®, we put our customers first and aim to give you the most up to date information. Please see the information below regarding required documentation for shipments post Brexit.

IMPORTANT! Information on EORI numbers

Considering shipping goods to/from Europe? In the UK, businesses, self-employed and private individuals involved in a commercial transaction must register, the same for businesses and self-employed within the EU, so before exporting/importing it is essential to make sure that both you and your customers/suppliers in Europe have the EORI numbers (unless your EU customer is a private individual and the goods in question are personal effects, in which case they do not need it)

Register for an EORI number now

Collect from |

Deliver to |

Commercial Invoice(for goods that are subject of a sale) |

Proforma Invoice(for personal effects) |

VAT * |

EORI ** |

|---|---|---|---|---|---|

| Great Britain | Europe | ||||

| Europe | Great Britain | ||||

| Northen Ireland | Europe | ||||

| Europe | Northen Ireland | ||||

| Northen Ireland | Rep. of Ireland | ||||

| Rep. of Ireland | Northen Ireland | ||||

| Great Britain | Northen Ireland | ||||

| Northen Ireland | Great Britain | ||||

| Rep. of Ireland | Great Britain | ||||

| Great Britain | Rep. of Ireland | ||||

| Rep. of Ireland | Europe | ||||

| Europe | Rep. of Ireland |

The team at Pallet2Ship® are working to ensure our customers can continue their pallet deliveries to and from the EU without difficulty. We'll handle as many concerns as we can for you, but meeting the requirements above is important before you place an order.